- #Bitsafe bank account android

- #Bitsafe bank account download

- #Bitsafe bank account free

NB applicant does not have other Dutch payment account(s). Cost of bank account: €2,55 per month for payment account, including debit card. The card delivery is 3 working days after your application. Additional: A debit card is needed to activate your account and receive the IBAN. #Bitsafe bank account download

Next step: Download the Rabobank-app in Apple App Store or Google Play Store. #Bitsafe bank account free

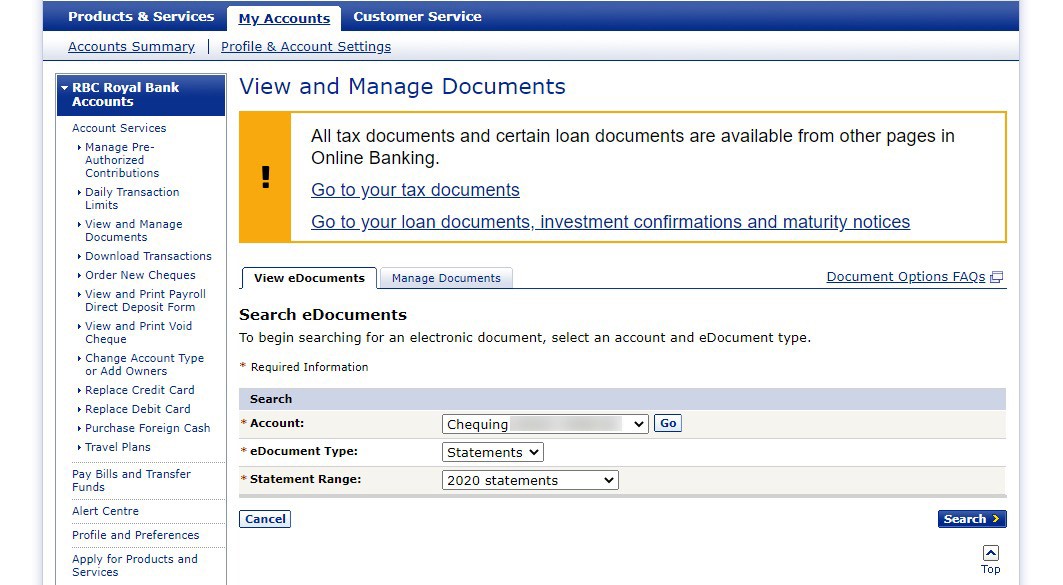

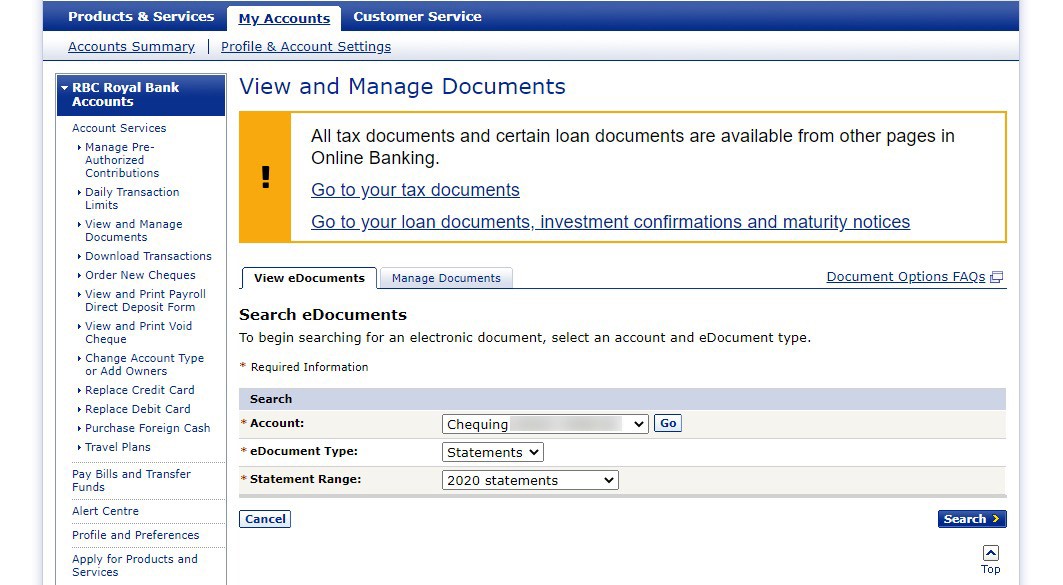

Cost of bank account: Free until Mafor Online Payment account, a debit card and the use of Apple Pay/Google Pay. Needed: Dutch Citizen Service Number (BSN). Next step: Go to the nearest ING branch. (€1,90 for digital only excluding ATM use) for a payment account, including debit card and the use of Apple Pay/Google Pay. Cost of bank account: €2,35 per month, no EU transaction fees. Needed: Dutch Citizen Service Number (BSN), proof of BRP-registration. Next step: Download the Bunq-app in Apple App Store or Google Play Store. Cost of bank account: 3 months free payment account, then €2,95 per month, including a debit card and the immediate use of Apple Pay/Google Pay. Next step: Download the Bitsafe-app in Apple App Store or Google Play Store. Cost of bank account: free payment account includes debit card (Transaction fees apply). Needed: Ukrainian passport, ID card or driver’s license. The card delivery is 3-5 working days after your application. Additional: Debit card is needed to activate the app.  Next step: Download the ABN AMRO-app in Apple App Store or Google Play Store. Cost of bank account: 1,95 per month for payment account, including debit card, identifier to activate the app. Needed: Ukrainian passport or ID card and Dutch Citizen Service Number (BSN). You can open a payment account at the following banks: ABN AMRO You can find general information at the Dutch Payments Association. In some cases, this can result in delays before the payment account is assigned to you and ready for use. Banks are obliged to check your data and ID. Opening of a payment account is subject to various rules and regulations. For this you must open a bank account with a Dutch bank account number (IBAN: NLxxBANKxxxxxxxxxx). After opening a bank account, you can let the City know what your bank account number (IBAN) is, so we can transfer your allowances for living expenses to it. Also, a local bank account means the City of Almere can transfer funds to you more easily and conveniently. This will make it easier for you to arrange various matters and help you participate in everyday life. Bitsafe’s products include providing Basic Payment Accounts, receiving and sending SEPA transactions, merchant credit card processing services, issuing the Bitsafe Debit Card, domain name registrations with extended privacy shield, network privacy and security services and trademark protection services.The City of Almere recommends you open a bank account in the Netherlands.

Next step: Download the ABN AMRO-app in Apple App Store or Google Play Store. Cost of bank account: 1,95 per month for payment account, including debit card, identifier to activate the app. Needed: Ukrainian passport or ID card and Dutch Citizen Service Number (BSN). You can open a payment account at the following banks: ABN AMRO You can find general information at the Dutch Payments Association. In some cases, this can result in delays before the payment account is assigned to you and ready for use. Banks are obliged to check your data and ID. Opening of a payment account is subject to various rules and regulations. For this you must open a bank account with a Dutch bank account number (IBAN: NLxxBANKxxxxxxxxxx). After opening a bank account, you can let the City know what your bank account number (IBAN) is, so we can transfer your allowances for living expenses to it. Also, a local bank account means the City of Almere can transfer funds to you more easily and conveniently. This will make it easier for you to arrange various matters and help you participate in everyday life. Bitsafe’s products include providing Basic Payment Accounts, receiving and sending SEPA transactions, merchant credit card processing services, issuing the Bitsafe Debit Card, domain name registrations with extended privacy shield, network privacy and security services and trademark protection services.The City of Almere recommends you open a bank account in the Netherlands. #Bitsafe bank account android

Our mobile application, available for both Android and iOS, allows us to identify our account holders fast and efficiently, without a face-to-face meeting.”įounded in 1998, Bitsafe stated its vision is to make the internet a safe place to engage in financial transactions, free from privacy infringement, identity theft and governmental control. We have developed a proprietary artificial intelligence technology that has adopted the latest anti-money laundering regulations and can detect illegal activity before a transaction is added to our ledgers. “Opening our accounts to the entire world means that we need to take additional steps to prevent abuse and money laundering.

Marcel Trik, CFO at Bitsafe, also commented: This results in zero credit risk and immediate availability of funds.” Funds in accounts are not stored with another bank, but with the central bank we work with. All Bitsafe accounts will bear a unique Dutch IBAN.

Thanks to new European legislation, Bitsafe is now able to accept customers from all over the world. “Residents of a given country are usually limited to opening a bank account with a bank in their home country or region. While sharing details about the accounts, Joost Zuurbier, CEO at Bitsafe, stated: According to the startup, this new account works just like a local bank account and allows account holders can make deposits, make payments and withdraw funds. Every Bitsafe account comes with a unique IBAN which allows sending and receiving payments globally, including to and from the SEPA region. Bitsafe, a Holland-based fintech, announced earlier this week the launch of its borderless Basic Payment Account.

0 kommentar(er)

0 kommentar(er)